iowa capital gains tax rates

Please remember that the income tax code is very complicated and while we can provide a good estimate of your Federal and Rhode Island income taxes your actual tax liability may be different. On the next page you will be able to add more details like itemized deductions tax credits capital gains and more.

The States With The Highest Capital Gains Tax Rates The Motley Fool

The long-term capital gains tax rate is going to be dependant on your taxable income and filing status but will fit within one of three rates.

. Zero percent 15 percent or 20 percent. Now lets talk a little bit about the specifics that come with selling a house in Idaho and the capital gains tax youll be. The Rhode Island Income Tax Rhode Island collects a state income.

Capital Gains Tax in Idaho.

Capital Gains Tax Iowa Landowner Options

Capital Gains Tax Calculator Real Estate 1031 Exchange Capital Gains Tax Capital Gain What Is Capital

How High Are Capital Gains Taxes In Your State Tax Foundation

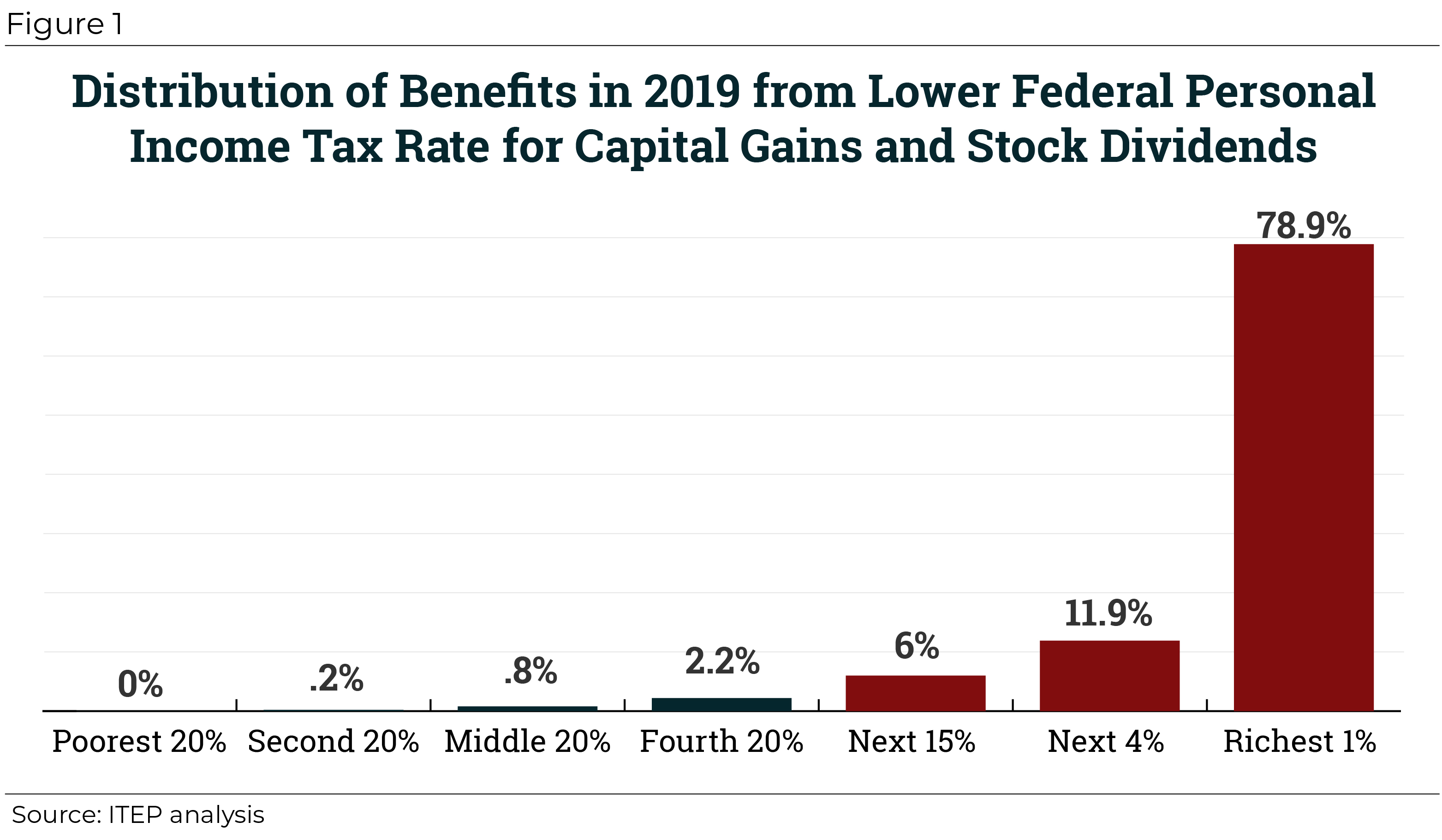

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

What Is Capital Gains Tax And When Are You Exempt Thestreet

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isn T Everything